E-Commerce in Saudi Arabia, 2017 | CITC

E-Commerce & Retail | KSA

In line with other emerging economies, the Saudi e-commerce market has been experiencing significant growth and development over the past few years. Saudi Arabia’s B2C e-commerce spending grew also making the country one of the largest e-commerce markets in the MENA region. This strong growth of B2C spending is driven by high levels of the internet, mobile and broadband penetration which estimated with 76% and 137% and 79.6%, respectively.

An overview of Saudi Arabia’s B2C E-Commerce Sector:

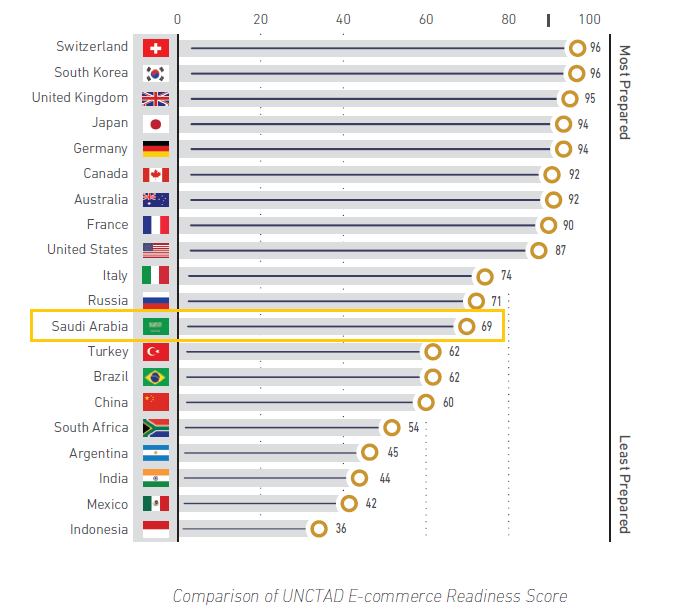

- In 2017, KSA ranked 46th out of 144 countries in the rank of e-commerce readiness brought by UNCTAD, and with an index score of 69, it is on par with countries such as Italy and Russia and higher placed than some larger economies like India and China.

- B2C e-commerce spending in KSA totaled SAR 29.7 billion in 2016 and is expected to grow at around 20% over the next few years.

Saudi Arabia B2C E-Commerce Spending (Buying Behavior of Individual Online Shoppers):

- 58% of the addressable Saudi population have shopped online at least once in the past. 87% of these online shoppers have made a transaction in the past 12 months.

- 86% of online shoppers have purchased goods and services from e-commerce companies located in KSA in the past 12 months, 65% have also made purchases from companies based in other GCC countries and 49% from outside the region.

- Games, consoles and subscriptions were more likely to be bought purely through online channels than any other category with a rate of 20%.

- When it comes to services, most shoppers of travel-related services such as airline bookings, hotel bookings, and tour packages make purchases through online channels with a rate of 31%.

- Most of the online shoppers in KSA are medium buys who buying once every 2 or 3 months (21% & 25%, respectively).

- Shoppers in KSA were more likely to pay with credit cards for their online purchases with a rate of 87%. This is followed by cash on delivery with a rate of 66% and bank transfer with only 45%.

Saudi Arabia B2C E-Commerce Spend (State of the Pure-Play E-commerce Industry):

- Small & medium enterprises (SMEs) in KSA that sell online spend an average of SAR 107,000 on ICT annually in 2016, with 13.8% of this budget allocated to e-commerce.

- The use of social media for marketing and selling is very limited in SMEs. Only 26% of respondents use social media to promote their products.

- SMEs also rely on search engine marketing and optimization (SEO/SEM) and – in some cases – email marketing to boost web traffic to their online stores.

A Graph Shows the Rank of KSA in the UNCTAD Comparison of E-commerce Readiness in 2017

Methodology:

CITC surveyed 783 individuals across the different regions of the KSA. CITC also surveyed 414 of small and medium enterprises across the kingdom. The surveys were conducted between April and May 2017. 66% of respondents are Saudi and 34% are non-Saudi.